PARIS, April 25 2024 — Atos, a global leader in digital transformation, high-performance computing and information technology infrastructure, today announced its performance for the first quarter of 2024.

Atos CEO Paul Saleh declared: “Tech Foundations and Digital are executing on their transformation plans. Business was nonetheless impacted by softer market conditions in key regions such as the Americas and Central Europe as well as delays in contract award.

Atos CEO Paul Saleh declared: “Tech Foundations and Digital are executing on their transformation plans. Business was nonetheless impacted by softer market conditions in key regions such as the Americas and Central Europe as well as delays in contract award.

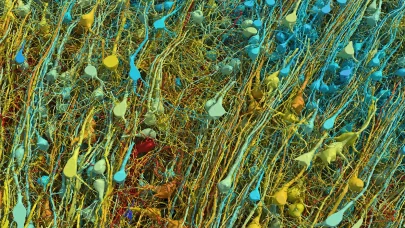

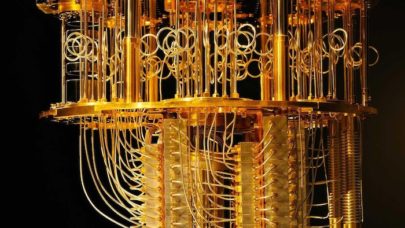

“During this quarter, our BDS business expanded its leadership in high-performance computing, with a new contract award in Denmark to accelerate research and innovation in various fields such as healthcare, life sciences, and the green transition, as well as with add-on work for existing HPC customers.

“On April 9, we outlined the key parameters of a refinancing framework to address our overall debt levels and upcoming debt maturities. We will update in the coming days those parameters to take into account the adjustment of our 2024-2027 business plan. We have therefore extended the deadline for submissions of refinancing proposals by existing stakeholders and third-party investors to May 3. We will review those proposals with our financial creditors and agree on an appropriate path forward. Our goal remains to agree on a refinancing solution by this coming July.

“I would like to take this opportunity to recognize our 94,000 employees for their commitment to giving our customers the highest quality of service delivery. I would like to also thank our customers and partners for their continued support.”

Revenue by Businesses

Group revenue was €2,479 million in Q1 2024, down -2.6% organically compared with Q1 2023.

Eviden revenue was €1,164 million, down -3.9% organically.

- Digital activities decreased mid-single digit. While revenue grew in continental Europe with public sector and utility customers, the business was impacted by the general market slowdown in Americas and by contract scope reductions in the United Kingdom.

- Big Data & Security (BDS) revenue decreased low single digit organically. Revenue in Advanced Computing was up slightly, with stronger activity in the public sector in France and in Asia. Revenue in Digital Security declined, impacted by a ramp up delay in a large project in Europe.

Tech Foundations was €1,314 million, down -1.5% organically.

- Core revenue (excluding BPO and value-added resale (“VAR”)) decreased by -3.6%. Stronger contributions related to the Paris Olympic & Paralympic games and the UEFA contract were offset by slowdown in public sector spending in Central Europe as well as by contract scope and volume reductions in Americas.

- Non-core revenue grew high-single digit, reflecting a strong demand for hardware and software products from European customers and a moderate growth in BPO activities in the United Kingdom.

Overall, revenue of the Group was impacted by delays in award of new contracts and add-on work, as clients await the final resolution of the Group’s refinancing plan.

Revenue by Regional Business Unit

Americas revenue decreased by -7.5% on an organic basis, reflecting the current general slowdown in market conditions. Digital services were down reflecting contract completions and volume decline in Healthcare and Insurance. The delivery of a supercomputer project in South America in Q1 2023 also provided a higher prior year comparison basis for BDS. Revenue in Tech Foundations was down due to a contract completion and scope reductions with select customers.

Northern Europe & Asia-Pacific revenue decreased by -3.2% on an organic basis. Eviden revenue declined high-single digit, reflecting a lower demand from Public Sector, Healthcare and Insurance customers. Revenue in Tech Foundations was slightly up with the contribution from Asia and increased BPO activity in the UK offsetting volume decline in the healthcare sector.

Central Europe revenue was down -3.8% on an organic basis. Eviden revenue slightly declined, as growth in Digital activities in Germany and Austria offset lower activities in BDS. Tech Foundations revenue declined high-single digit, reflecting delays in public sector spending.

Southern Europe revenue was up +0.7% organically. Eviden revenue grew mid-single digit, reflecting strong activity in High-Performance Computing. Digital activities grew as well, benefitting from the ramp-up of large contracts in Spain and with a major European utility company in France. Tech Foundations revenue declined low single-digit following contract completions with Banking and Public Sector customers.

Revenue in Others and global structures, which encompass Middle East, Africa, Major Events as well as the Group’s global delivery centers and global structures, strongly grew by 30% organically, reflecting strong performance in Major Events with the ramp up of activities related to the Paris Olympic & Paralympic games and the UEFA contract.

Commercial Activity

Order entry for the Group was €1,586 million. Eviden order entry was €966 million and Tech Foundations order entry was €620 million.

Book-to-bill ratio for the Group was 64% in Q1 2024, down from 73% in Q1 2023, reflecting delays in contract awards as clients await the final resolution of the Group’s refinancing plan.

Book-to-bill ratio at Eviden was 83%, improving by +4 points compared with the first quarter of 2023. The increase reflects large orders received by BDS, in particular an AI system that will perform medical and scientific research in Denmark and contracts to extend the computing capacity of existing HPCs: the Santos Dumont in Brazil and the Jean Zay in France. Main order intake also included an SAP implementation and maintenance contract for the European Union and an application maintenance contract with a public sector customer in Central Europe.

At Tech Foundations, Q1 book-to-bill was 47%, down from 68% in Q1 2023. Despite the signature of several large contact renewals, notably in Hybrid Cloud & Infrastructure with a Transportation customer and in Digital Workplace with a client in the financial sector in Americas, signature of new outsourcing contracts was delayed due to the current low demand for new services from public sector customers in Central Europe and the impact of customers delaying decisions on major IT projects, as they await the final resolution on our refinancing plan.

At the end of March 2024, the full backlog was €17.3 billion representing 1.7 years of revenue. The full qualified pipeline amounted to €6.0 billion at the end of March 2024.

Operating Margin

Group operating margin in the first quarter of 2024 was €48 million representing 1.9% of revenue, compared with 3.3% in prior year.

Eviden operating margin was €22 million or 1.9%, down -330 basis points organically. Eviden’s profitability decreased, impacted by revenue decrease, lower utilization of billable resources and investment in Advanced Computing.

Tech Foundations operating margin was €26 million or 2.0%, up +50 basis points organically, reflecting the continued execution of its transformation program.

Based on current market conditions and business performance for the first quarter of the year, Atos will adjust its 2024-2027 business plan and communicate any revisions in the coming days.

Q1 2024 Cash and Net Financial Debt

As of March 31, 2024, cash & cash equivalents and short-term financial assets was €1.0 billion, down €1.4 billion compared with December 31, 2023 primarily reflecting €1.3 billion lower working capital actions compared with the end of fiscal 2023.

As of March 31, 2024, net debt was €3.9 billion compared with €2.2 billion at the end of last year, reflecting primarily the reduction of the working capital actions.

Interim Financing

The implementation of the interim financing of €450 million with groups of banks and bondholders and the French state communicated on April 9, 2024 is progressing.

Refinancing Discussions with Financial Creditors Progressing with a Target Resolution by July 2024

Atos SE has entered into an amicable conciliation procedure in order to frame discussions with its financial creditors. This is to facilitate the emergence of a global agreement regarding the restructuring of its financial debt within a short and limited timeframe of four months, which could be further extended by one month if needed.

In this context, Atos SE presented the key parameters of its refinancing framework to its financial creditors on April 8, 2024.

Based on current market conditions and business performance for the first quarter of the year, Atos will adjust its 2024-2027 business plan, which should lead to an increase of its parameters for cash needed to fund the business and for a potential additional debt reduction.

Proposal submission date by existing stakeholders of Atos SE and third-party investors is pushed out to May 3, 2024 to give all stakeholders time to incorporate new information, which will be communicated in the coming days.

Atos will evaluate all proposals, under the aegis of the conciliator Maître Hélène Bourbouloux in the best corporate interest of the Company including its employees, clients, suppliers, shareholders, and other stakeholders, while maintaining an attractive business mix. Atos will also take into consideration the sovereign imperatives of the French state.

Atos aims for a global agreement on the new capital structure of the Company to be finalized by July 2024.

Atos will inform the market in due course of the progress of the refinancing discussions, which will result in a change in its capital structure arising from a final global refinancing agreement, including the potential issuance of new equity which will result in a dilution of the existing shareholders.

Shareholders and financial creditors will be consulted in compliance with French legal requirements.

As a reminder, the financial parameters of the refinancing framework provided by the Group are based on the Group’s current perimeter, which includes the assets of Eviden and Tech Foundations without taking into account the impact of any potential asset disposals.

These parameters act as guidelines for all interested parties who will ultimately present their proposals to the company and the conciliator.

About Eviden

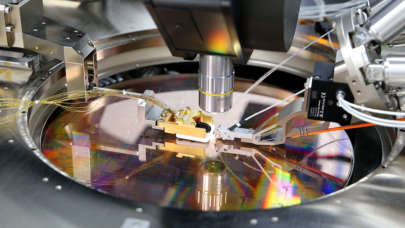

Eviden is a next-gen technology leader in data-driven, trusted and sustainable digital transformation with a strong portfolio of patented technologies. With worldwide leading positions in advanced computing, security, AI, cloud and digital platforms, it provides deep expertise for all industries in more than 47 countries. Bringing together 47,000 world-class talents, Eviden expands the possibilities of data and technology across the digital continuum, now and for generations to come. Eviden is an Atos Group company with an annual revenue of c. € 5 billion.

About Atos

Atos is a global leader in digital transformation with c. 94,000 employees and annual revenue of c. € 11 billion. European number one in cybersecurity, cloud and high-performance computing, the Group provides tailored end-to-end solutions for all industries in 69 countries. A pioneer in decarbonization services and products, Atos is committed to a secure and decarbonized digital for its customers. Atos is a SE (Societas Europaea), and listed on Euronext Paris.

Source: Atos